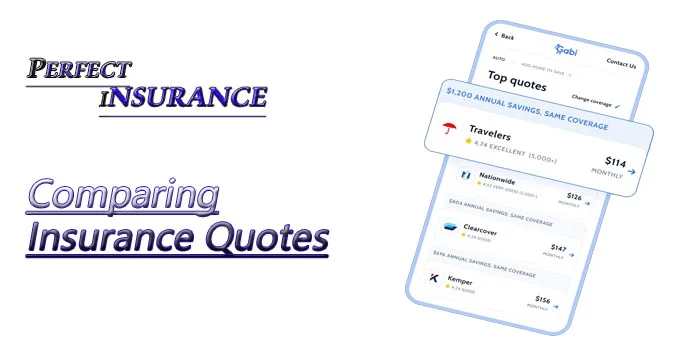

Comparing Insurance Quotes from Different Providers

When delving into the process of comparing insurance quotes from diverse insurance company,, it’s essential to take a more nuanced approach. Here’s a detailed exploration of each step to ensure a comprehensive understanding:

Identify Insurance Needs:

Understanding your insurance needs involves more than just categorizing them. Consider the specific coverage requirements based on your lifestyle, assets, and future plans. Are you looking for comprehensive coverage or focusing on specific aspects of insurance such as liability, deductibles, or additional riders?

Gather Relevant Information:

Beyond user reviews and consumer reports, dig deeper into the reputation and financial stability of each insurance provider. Look into their claims processing efficiency, customer service responsiveness, and overall satisfaction levels. Reliable information ensures a more informed decision.

Research Insurance Providers:

Moving beyond a superficial glance at insurance providers, a thorough investigation of their reputation is crucial. Customer reviews become narrative insights, unveiling real-world experiences and shaping a more informed perspective.

Compare Coverage Options:

Transitioning from a surface-level comparison to a meticulous evaluation of coverage options is essential. Unpacking the nuances of each policy ensures not only meeting basics but aligning intricately with unique requirements.

Obtain Quotes to comparison insurance quotes:

Transforming the act of obtaining quotes into a strategic initiative involves seeking quotes with a discerning eye. This ensures they encapsulate the same breadth of coverage and engaging with providers for clarification.

Evaluate Premium Costs:

Shifting from a cursory glance at premium costs to a sophisticated analysis involves delving into the intricacies of premium structure. Considerations include upfront payments versus monthly installments and projecting long-term financial implications.

Understand Deductibles:

Elevating the understanding of deductibles beyond numerical values is crucial. Uncovering the impact of opting for higher or lower deductibles on both short-term costs and potential future claims becomes a focal point.

Review Policy Limits:

Moving beyond a casual review of policy limits to a strategic examination involves gauging adequacy for current assets and projecting future needs. The policy should be dynamic, growing with changing circumstances.

Check for Discounts:

Viewing the quest for discounts as an optimization strategy goes beyond mere cost-cutting. Exploring bundling options and safety features becomes paramount for both savings and enhanced protection.

Examine Exclusions and Special Conditions:

Elevating the scrutiny of policy fine print beyond a legal formality involves uncovering the subtleties of exclusions and special conditions. Understanding their implications in real-life scenarios is crucial for informed decision-making.

Consider Customer Service:

Transitioning from a casual consideration of customer service to a pivotal factor involves delving into customer experiences regarding claim processing efficiency, responsiveness, and overall satisfaction.

Assess Financial Stability:

Moving beyond a basic check of financial stability to an in-depth assessment involves investigating the financial health of insurance providers. This analysis ensures their capacity to handle claims, especially in the face of widespread events.

Review Policy Flexibility:

In the meticulous examination of policy adaptability, the endeavor transcends the mere anticipation of potential alterations; it metamorphoses into a strategic scrutiny of a policy’s aptitude to dynamically respond to the multifaceted facets of existence. The proficiency to customize coverage in alignment with the ever-evolving requisites ensures the insurance maintains its stalwart and pertinent fortification throughout the trajectory of the policyholder’s odyssey. As patrons, discerning the significance of policy adaptability endows us with the authority to craft decisions that harmonize with the perpetual flux of our lives.

Consult with an Insurance Advisor:

Elevating the consultation with an insurance advisor from an optional step to a crucial one involves seeking their expertise not just for clarification but as a strategic partnership. Leveraging their insights becomes essential for navigating policy complexities and options.

Conclusion:

In conclusion, the pursuit of insurance transcends a mere transaction; it demands a thorough and thoughtful engagement. By delving into each step with an inquisitive mindset and a discerning eye, one can secure not only coverage but cultivate a robust and tailored shield that stands resilient in the face of evolving needs and unexpected challenges.