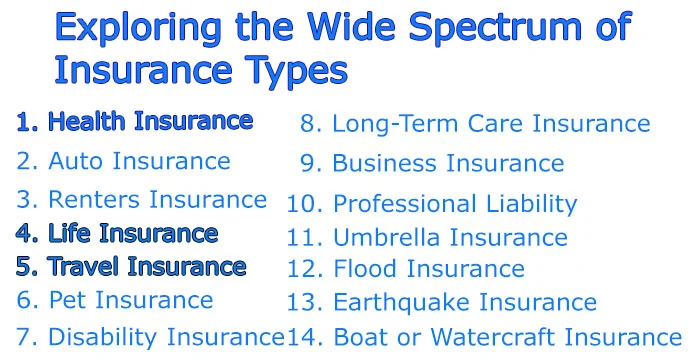

A Comprehensive Guide to Insurance: Exploring the Wide Spectrum of Insurance Types

Insurance is the safety net that provides financial security and peace of mind in the face of life’s uncertainties. It’s a crucial component of a well-rounded financial plan, offering protection against various risks and unexpected events. In this comprehensive guide, we’ll delve into the world of insurance, exploring the multitude of insurance types available and understanding why each one plays a significant role in safeguarding different aspects of our lives.

1. Health Insurance

Health insurance stands as one of the most vital forms of insurance. It ensures that you have access to quality healthcare when you need it most. Health insurance covers medical expenses, doctor visits, hospital stays, prescription medications, and preventive care. It can be obtained through employers, government programs (such as Medicare or Medicaid in the United States), or private insurers. Health insurance is essential for managing healthcare costs, especially in countries without universal healthcare systems.

2. Auto Insurance

Auto insurance is mandatory in most countries and is designed to protect you financially in the event of an accident or damage to your vehicle. It typically includes liability coverage, collision coverage, and comprehensive coverage. The type of coverage you need may depend on the value of your car and your individual circumstances. Auto insurance is crucial for safeguarding both your assets and your financial well-being.

3. Homeowners or Renters Insurance

Homeowners insurance is essential for homeowners to protect their homes and personal belongings. It covers damages to your home caused by events like fire, theft, or natural disasters. Additionally, it provides liability coverage in case someone is injured on your property. For renters, renters insurance offers similar protection for personal belongings and liability without covering the structure itself. These types of insurance are critical for ensuring financial stability and protecting your assets.

4. Life Insurance

Life insurance provides a safety net for your loved ones in the event of your passing. It offers a death benefit to your beneficiaries, which can help cover outstanding debts, funeral expenses, and provide financial security. There are various types of life insurance, including term life, whole life, and universal life, each with unique features and benefits. The choice of life insurance depends on your financial goals and the needs of your loved ones.

5. Travel Insurance

Travel insurance is designed to protect travelers from unforeseen events that can disrupt or cancel their travel plans. It includes coverage for trip cancellation, trip interruption, medical emergencies, lost luggage, and more. Travel insurance is an essential companion for those who travel frequently, ensuring peace of mind during their journeys. It provides financial protection when you encounter unexpected challenges while away from home.

6. Pet Insurance

Pet insurance is designed to cover veterinary expenses for your furry friends. It can help you manage the cost of medical care for your pets, including vaccinations, surgeries, and treatments for injuries or illnesses. Pet insurance can be a financial lifesaver, particularly when faced with unexpected veterinary bills. It allows you to provide the best care for your pets without worrying about the associated costs.

7. Disability Insurance

Disability insurance serves as income replacement if you are unable to work due to a disability or illness. It ensures that you continue to receive a portion of your salary, helping you maintain your standard of living during challenging times. Disability insurance is crucial for individuals who rely on their income to support themselves and their families. It provides financial security and peace of mind in the event of unexpected setbacks.

8. Long-Term Care Insurance

Long-term care insurance is designed to cover the costs associated with long-term care, such as nursing home care, assisted living, or in-home care. It can be crucial for individuals who want to ensure they have financial support in their later years, as healthcare expenses can be significant in old age. Long-term care insurance provides peace of mind and allows you to age with dignity while maintaining your financial independence.

9. Business Insurance

Business insurance is vital for entrepreneurs and business owners. It includes various types of coverage, such as property insurance, liability insurance, and business interruption insurance. Business insurance safeguards your enterprise from financial losses due to unexpected events, allowing your business to recover and continue operations. It protects your investments, employees, and the continuity of your business, making it a cornerstone of successful entrepreneurship.

10. Professional Liability Insurance

Professional liability insurance, often known as errors and omissions insurance, is crucial for professionals in various fields, such as doctors, lawyers, consultants, and real estate agents. It protects against claims of negligence or professional errors, providing financial protection and peace of mind in the event of a lawsuit. This type of insurance is critical for maintaining your professional reputation and financial well-being.

11. Umbrella Insurance

Umbrella insurance serves as an extra layer of liability protection beyond the coverage provided by your home, auto, or other insurance policies. It’s especially valuable for individuals who want extended liability coverage in case of lawsuits or claims that exceed their standard policy limits. Umbrella insurance provides added peace of mind, knowing you have an additional safety net in place.

12. Flood Insurance

Flood insurance is a specific type of coverage that protects against damages caused by flooding. Standard homeowners insurance policies typically do not cover flood-related damages, making flood insurance essential for individuals living in flood-prone areas. It ensures that your property and personal belongings are safeguarded from the financial impact of flood damage.

13. Earthquake Insurance

Earthquake insurance provides coverage for damages resulting from earthquakes. It’s essential for individuals living in regions prone to seismic activity, as standard home insurance policies do not typically cover earthquake-related damages. Earthquake insurance offers financial protection and ensures that you can recover from the potentially devastating effects of an earthquake.

14. Boat or Watercraft Insurance

Boat or watercraft insurance protects boat owners from the financial consequences of accidents, damage, or theft related to their watercraft. It is especially important for boat owners who want to enjoy their water activities with peace of mind. Boat insurance safeguards your investment in watercraft and ensures that you can continue to enjoy your aquatic adventures without financial worry.

15. Collector’s Insurance

Collector’s insurance is tailored for enthusiasts who collect valuable items such as art, antiques, rare collectibles, or vintage cars. It provides protection against theft, damage, or loss of these prized possessions. Collector’s insurance allows collectors to preserve the value of their collections and ensure that their treasured items are protected.

16. Crop Insurance

Crop insurance is crucial for farmers and agricultural businesses. It safeguards against crop loss due to weather events, pests, or other unforeseen circumstances. Crop insurance helps farmers manage risks and maintain their livelihoods, providing financial stability in the unpredictable world of agriculture. In the heartlands of agriculture, this practice bestows upon farmers the precious gift of unwavering confidence. It serves as a radiant beacon, illuminating the path of financial security and stability. Here, amidst the lush fields and the sweat of toil, farmers find solace in the assurance that their dreams and livelihoods are cocooned in the protective embrace of this practice, allowing them to sow, nurture, and harvest with hearts unburdened by the looming shadows of uncertainty.

17. Cyber Insurance

Cyber insurance is designed to protect individuals and businesses from financial losses resulting from data breaches, cyberattacks, or other digital threats. In an increasingly digital world, this type of insurance is

becoming more critical than ever. Cyber insurance provides financial security and expertise in navigating the complex landscape of digital threats, ensuring that your financial interests and sensitive information are safeguarded.

18. Event Cancellation Insurance

Event cancellation insurance is essential for event organizers and planners. It covers financial losses resulting from the cancellation, postponement, or disruption of events due to unforeseen circumstances. Event cancellation insurance ensures that the financial investment in an event is protected, providing peace of mind for event organizers and participants. It allows you to plan and host events with confidence, knowing that unexpected challenges won’t result in significant financial losses.

19. Kidnap and Ransom Insurance

Kidnap and ransom insurance provides coverage in situations where individuals or their loved ones are at risk of kidnapping or extortion. It offers financial protection as well as expert assistance in managing such challenging and dangerous situations. Kidnap and ransom insurance is essential for individuals, business executives, or organizations operating in high-risk environments. It ensures that you have the resources and expertise needed to respond effectively to potentially life-threatening situations.

20. Wedding Insurance

Wedding insurance safeguards the financial investment in a wedding ceremony. It covers cancellations, unexpected expenses, and other issues that may arise in the planning and execution of a wedding. Wedding insurance ensures that the special day proceeds smoothly and is protected from unexpected challenges. It provides financial security for couples planning their wedding and offers peace of mind during the entire wedding planning process.

21. Title Insurance

Title insurance is vital in real estate transactions. It protects buyers and lenders from financial losses related to title issues, such as disputes over property ownership or undisclosed claims on a property’s title. Title insurance ensures that real estate transactions proceed smoothly and that buyers have clear ownership of their property, free from any legal disputes or complications.

22. Credit Insurance

Credit insurance covers the outstanding balance of a loan or credit card in the event of the borrower’s death, disability, or unemployment. It provides financial protection for both borrowers and lenders in the event of unforeseen circumstances. Credit insurance ensures that borrowers and lenders can navigate the uncertainties of life without the burden of outstanding debt in case of unexpected events.

23. Artisan Insurance

Artisan insurance is tailored for skilled trade professionals and artisans, such as plumbers, electricians, and carpenters. It provides coverage for liability, property damage, and other specific risks related to their trade. Artisan insurance ensures that skilled professionals have the financial protection needed to navigate their unique challenges and protect their businesses.

24. Terrorism Insurance

Terrorism insurance offers coverage for businesses and individuals in the event of damages or losses resulting from acts of terrorism. It provides financial protection in an uncertain world, ensuring that individuals and businesses can recover and rebuild in the face of terrorism-related events.

25. Directors and Officers Insurance

Directors and officers insurance protects individuals serving on the boards of corporations or nonprofit organizations from personal losses resulting from legal actions related to their roles. It provides financial protection and ensures that individuals are willing to take on leadership positions in organizations without the fear of personal financial liability.

26. Weather Insurance

Weather insurance covers financial losses related to adverse weather conditions, such as hurricanes, droughts, or excessive rainfall. It’s crucial for businesses and individuals whose livelihoods are dependent on weather-sensitive activities, such as farming or outdoor events. Weather insurance offers peace of mind and financial protection in the unpredictable world of weather-related challenges.

27. Niche Insurance Policies

Beyond these more common insurance types, there are numerous niche insurance policies tailored to specific needs and circumstances. These may include insurance for fine art, specific sporting events, prize indemnity, or even insurance for celebrities’ body parts. Niche insurance policies are designed to address unique risks and offer financial protection in specialized areas of life and business.

28. Self-Insurance

Self-insurance is a method where individuals or businesses set aside funds to cover potential losses instead of purchasing traditional insurance policies. It’s a way to assume the financial risk personally rather than transferring it to an insurance company. The art of self-insurance, frequently embraced by corporate giants boasting ample financial fortitude, symbolizes a bold stance in navigating the turbulent waters of risk management. It reflects a profound commitment to self-reliance, a pledge to steer one’s ship through the treacherous sea of uncertainties, and an unyielding determination to shoulder the burdens of potential losses without flinching.

29. Blockchain and Cryptocurrency Insurance

In the rapidly evolving world of blockchain and cryptocurrencies, insurance policies are emerging to cover risks associated with digital assets, hacking, and crypto-related events. These policies offer protection for those involved in the blockchain and cryptocurrency industry, safeguarding their investments and assets in the digital realm.

30. Infectious Disease Insurance

The COVID-19 pandemic brought attention to the need for insurance policies that cover infectious diseases. Amid the realm of safeguarding enterprises and gatherings from the repercussions of epidemics, we encounter the formidable realm of “Contagious Ailment Assurance.” This form of assurance is diligently crafted to shield the interests of businesses and events in the clutches of pandemics, endowing them with financial sanctuary and an unswerving thread of operational continuity in the face of formidable public health crises.

31. Future of Insurance

The insurance industry continues to evolve, with the emergence of innovative policies and insurtech solutions. The future of insurance may include more personalized coverage, blockchain-based policies, and AI-driven underwriting. As our world changes, insurance will adapt to provide new ways to address emerging risks and challenges.

Conclusion

In conclusion, the world of insurance is vast and diverse, offering a wide spectrum of policies to safeguard different aspects of our lives and businesses. From health and auto insurance that protect our well-being and vehicles to life and travel insurance that provide peace of mind during life’s adventures, insurance is a financial safety net that allows us to navigate life’s uncertainties with confidence. By understanding the multitude of insurance types available, you can make informed decisions to protect yourself, your loved ones, and your assets, ensuring financial stability and peace of mind in an unpredictable world.

As you consider your insurance needs, remember that each type of insurance serves a unique purpose. Tailor your coverage to your specific circumstances and priorities, ensuring that you have