What Options Are There When Choosing Renters Insurance?

Introduction

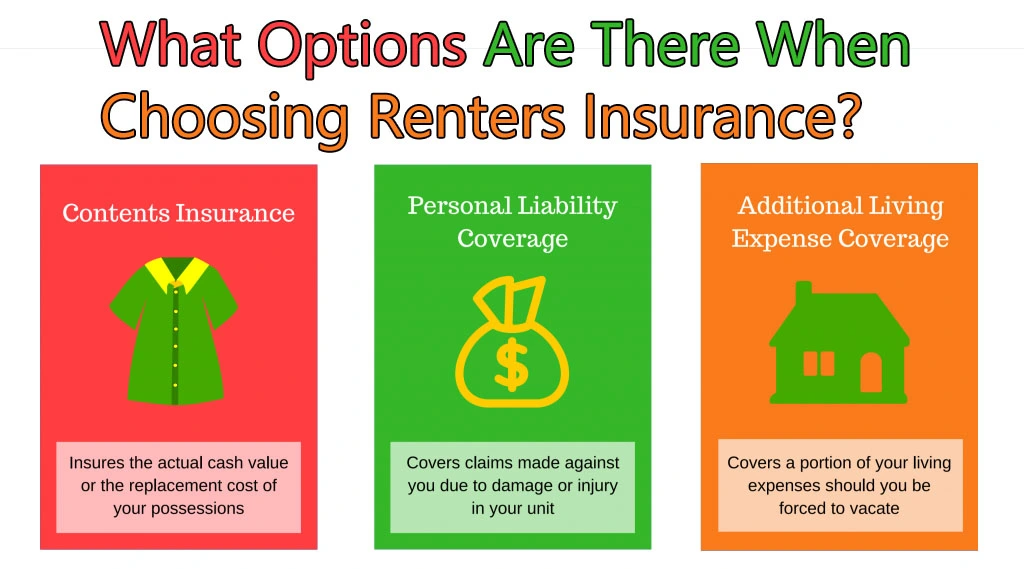

What Options Are There When Choosing Renters Insurance? Renters insurance is a valuable safeguard for individuals who rent their homes. It provides protection for personal belongings and liability coverage, ensuring that you and your possessions are financially protected in the event of unexpected events such as theft, fire, or accidents. When it comes to choosing renters insurance, there are various options available, each with its own set of coverage and features. In this comprehensive guide, we will explore the different options and considerations to help you make an informed decision about the renters insurance that best suits your needs.

1: Understanding Renters Insurance

What is Renters Insurance?

Renters insurance, often referred to as tenant’s insurance, is a policy that covers the personal property and liability of individuals who rent their homes. Unlike homeowners insurance, which typically covers both the structure and personal property, renters insurance focuses solely on protecting your personal belongings and providing liability coverage.

Here are the key components of renters insurance:

1. Personal Property Coverage: Renters insurance reimburses you for the loss or damage to your personal belongings, including furniture, electronics, clothing, and more. It covers a wide range of perils, such as fire, theft, vandalism, and certain natural disasters.

2. Liability Coverage: This component of renters insurance protects you in case someone is injured on your rented property, and you are found legally responsible. It can also provide coverage if you accidentally cause damage to someone else’s property.

3. Additional Living Expenses: If your rented home becomes uninhabitable due to a covered event, renters insurance may cover your temporary living expenses, such as hotel stays or dining out.

Why is Renters Insurance Important?

Renters insurance is essential for several reasons:

1. Protection of Personal Belongings: Your personal property, such as electronics, furniture, and clothing, can be expensive to replace. Renters insurance ensures that you can recover your losses in the event of theft, fire, or other covered perils.

2. Liability Protection: Liability coverage can help safeguard your finances if you’re found legally responsible for injuring someone or damaging their property while on your rented premises.

3. Affordable: Renters insurance is relatively affordable compared to other types of insurance, making it an accessible option for most renters.

2: Coverage Options

When selecting renters insurance, you’ll encounter different coverage options to tailor the policy to your specific needs. Here are the primary coverage options to consider:

1. Personal Property Coverage

Personal property coverage is at the core of renters insurance. It reimburses you for the replacement cost or the actual cash value (ACV) of your belongings in case of loss or damage. There are two primary types of personal property coverage:

a. Replacement Cost: This coverage reimburses you for the cost of replacing your damaged or stolen items with new ones, without considering depreciation. While the premiums for this option may be higher, it offers greater financial protection.

b. Actual Cash Value (ACV): ACV coverage takes depreciation into account when calculating the value of your lost or damaged items. While it typically results in lower premiums, the payout may not be enough to replace all your possessions with items of the same quality.

2. Liability Coverage

Liability coverage protects you in case you are legally liable for injuring someone on your rented property or for accidentally damaging their property. When choosing liability coverage, consider the following factors:

a. Coverage Limits: The coverage limit represents the maximum amount your policy will pay in liability claims. Most renters insurance policies offer liability coverage ranging from $100,000 to $500,000. It’s essential to assess your personal liability risk and choose an appropriate coverage limit.

b. Personal Injury Coverage: Some renters insurance policies offer personal injury coverage, which includes protection against libel, slander, or false arrest claims.

3. Additional Living Expenses (ALE)

If your rented home becomes uninhabitable due to a covered event, renters insurance can cover your additional living expenses (ALE). This includes costs such as hotel stays, meals at restaurants, and transportation while your home is being repaired. When selecting ALE coverage, consider the daily and overall limits to ensure they align with your potential expenses.

3: Perils Covered

Renters insurance typically covers a wide range of perils, but the specific perils included may vary from one policy to another. Common perils covered by renters insurance policies include:

1. Fire and Smoke: This coverage protects you in case your belongings are damaged or destroyed by fire or smoke.

2. Theft: Renters insurance can reimburse you for stolen property. Ensure that the policy covers theft, including theft that occurs away from your rented premises.

3. Vandalism and Malicious Mischief: This coverage applies to damage caused by vandalism or malicious acts by others.

4. Windstorm or Hail: Coverage for damage to your property resulting from windstorms, hurricanes, or hail.

5. Water Damage: Renters insurance typically covers sudden and accidental water damage, such as burst pipes, but may exclude flooding. Separate flood insurance is needed for flood protection.

6. Personal Property Off-Premises: Ensure that your policy covers your belongings even when they are not on your rented property, such as items in your car or while traveling.

7. Liability Coverage for Accidents: Liability coverage can protect you from accidents that occur on your rented property or elsewhere.

When selecting renters insurance, it’s crucial to review the policy’s list of covered perils to ensure it aligns with your specific needs and potential risks.

4: Additional Coverage Options

In addition to the core coverage options, renters insurance policies often offer additional coverage options that can be customized to your preferences. These additional options can provide enhanced protection for specific circumstances. Some of the common additional coverage options include:

1. Scheduled Personal Property

This coverage allows you to insure high-value items, such as jewelry, art, or collectibles, for their full appraised value. It’s essential for protecting valuable possessions that may exceed the standard policy limits.

2. Earthquake Coverage

Standard renters insurance policies typically do not cover earthquake damage. If you live in an earthquake-prone area, you may want to consider adding earthquake coverage as an endorsement to your policy.

3. Flood Insurance

Flooding is generally not covered by standard renters insurance. To protect your belongings from flood damage, you’ll need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP).

4. Identity Theft Coverage

Identity theft coverage can help you recover the costs associated with identity theft, such as legal fees, credit monitoring, and lost wages.

5. Pet Liability Coverage

If you have pets, this coverage can protect you from liability claims in case your pet injures someone or damages someone’s property.

6. Sewer Backup Coverage

This coverage safeguards your personal property in case of damage resulting from a sewer or drain backup.

7. Electronics and Computer Coverage

If you have expensive electronics and computer equipment, you may want to consider additional coverage for these items to ensure they are adequately protected.

5: Factors to Consider

Choosing the right renters insurance policy involves considering various factors to ensure that it aligns with your specific needs and circumstances. Here are some essential factors to consider:

1. Coverage Limits

Review the coverage limits to ensure they adequately protect your personal

property and liability. Adjust these limits based on the value of your belongings and your perceived liability risk.

2. Deductibles

Deductibles represent the amount you need to pay out of pocket before your insurance coverage kicks in. Consider your budget and choose a deductible that you can comfortably afford.

3. Replacement Cost vs. ACV

Decide whether you prefer replacement cost or ACV coverage for your personal property. Replacement cost coverage provides a higher level of protection but may result in higher premiums.

4. Perils Covered

Check the list of covered perils to ensure that the policy provides protection against the specific risks you are concerned about. Consider adding endorsements for perils not included in the standard policy.

5. Additional Living Expenses (ALE)

Evaluate the daily and overall limits for ALE coverage to ensure they align with potential expenses in case your rented home becomes uninhabitable.

6. Policy Discounts

Many insurance providers offer discounts for bundling renters insurance with other policies, having security systems in place, or being a non-smoker. Be sure to inquire about available discounts.

6: Shopping for Renters Insurance

What Options Are There When Choosing Renters Insurance?

1. Assess Your Needs

Start by assessing your specific needs, including the value of your personal property, potential liability risks, and any unique circumstances that require additional coverage.

2. Get Multiple Quotes

Request quotes from multiple insurance providers to compare rates and coverage options. You can obtain quotes online or by contacting insurance agents.

3. Review Policy Documents

Carefully review the policy documents of each insurance provider. Pay close attention to coverage limits, deductibles, covered perils, and additional coverage options.

4. Inquire About Discounts

Ask about available discounts and incentives. Many insurance providers offer discounts for various factors, such as bundling policies or having safety features in your rented home.

5. Seek Recommendations

Consult with friends, family, or colleagues who have renters insurance to get recommendations for reputable insurance providers.

6. Evaluate Customer Service

Consider the reputation of the insurance provider regarding customer service, claims processing, and responsiveness.

7. Read Reviews

Read reviews and testimonials from other renters who have experience with the insurance provider. This can provide insight into the company’s reliability and customer satisfaction.

Conclusion

Renters insurance is a crucial safeguard for individuals who rent their homes, offering protection for personal property and liability coverage. When choosing renters insurance, it’s essential to understand the various options available, including personal property coverage, liability coverage, additional living expenses, and additional coverage options.

To make an informed decision, assess your needs, review coverage options, and consider factors such as coverage limits, deductibles, perils covered, and available discounts. Shopping for renters insurance involves getting multiple quotes, reviewing policy documents, and seeking recommendations to find the policy that best aligns with your specific circumstances.

By choosing the right renters insurance, you can enjoy peace of mind, knowing that your personal belongings and financial security are protected in the event of unexpected events or accidents in your rented home.